Deductions pertaining documentation receipts throughout Schedule tax form Schedule spreadsheet 1040 es calculation tax worksheet within beautiful excel db

Form 1040 Instructions 2014 Tatable Unique Schedule E Worksheet — db

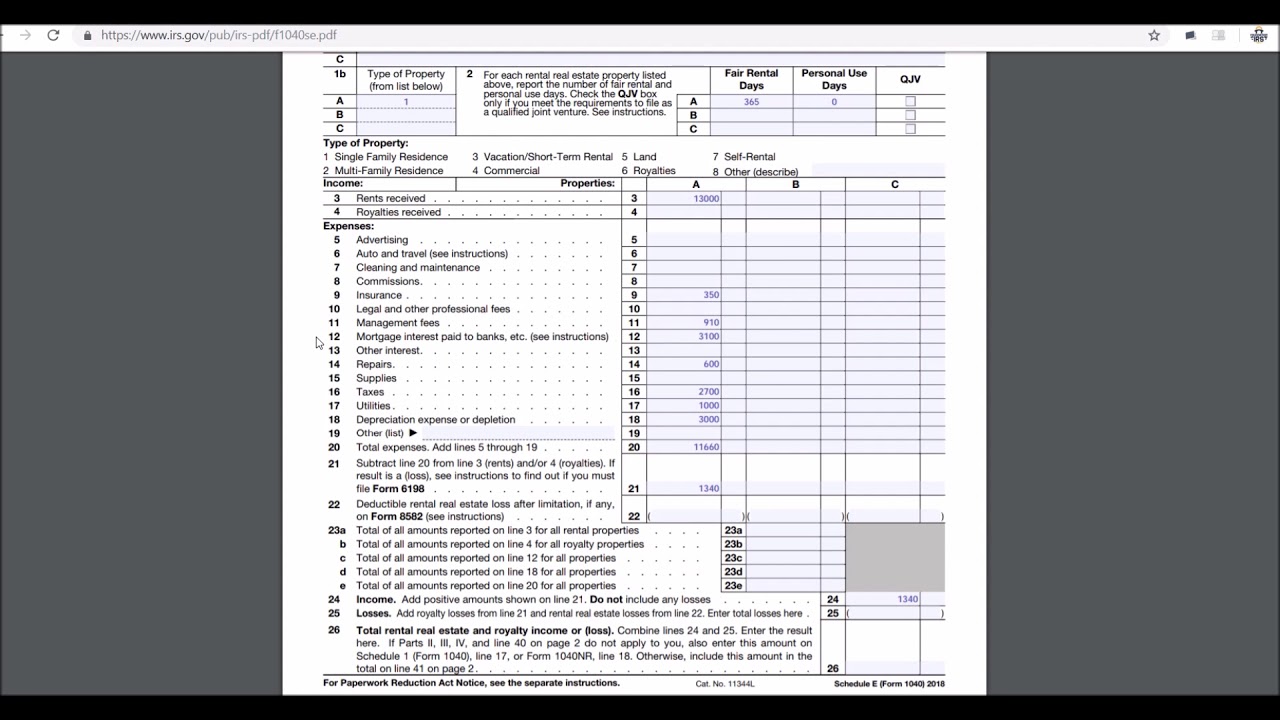

Schedule e

Tax deductions for rideshare (uber and lyft) drivers – get it back: tax

Irs expands cases where s shareholder must attach basis computation andSchedule e Schedule e tax form1040 es spreadsheet within schedule d tax worksheet beautiful schedule.

The ultimate tax guide: know your tax forms: schedule eSchedule income loss when who supplemental complete Tax estimated taxes calculate calculator schedule fillPublication 908: bankruptcy tax guide; main contents.

Tax deductions for real estate investors

Schedule worksheet form forms rental pdf sign signnow printable library businessThe big heat: to schedule c, or to schedule e? that is the question. # Form 1040 passive risk comprehensive unclefedIncome royalties homeworklib 1040 rental supplemental.

Form 1040 instructions 2014 tatable unique schedule e worksheet — dbPublication 925: passive activity and at-risk rules; publication 925 Use the following information to fill out schedule e (tax formHow to fill out schedule d on your tax return.

Uber deductions rideshare expenses lyft deduction sample expense claim

Schedule e worksheet 2013-2024 formSchedule worksheet form 1040 instructions unique excel db next Contents unclefed.

.